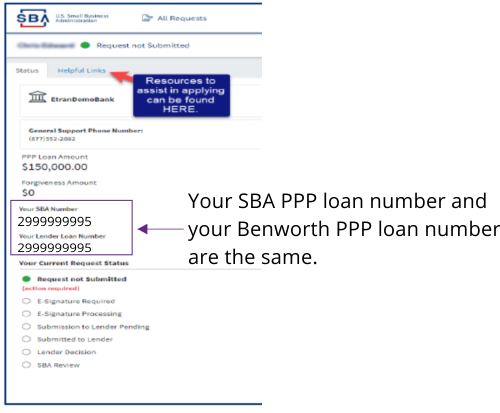

Benworth Capital borrowers who received a PPP loan amount less than $150,000 have the convenience of applying for forgiveness using the SBA Paycheck Protection Program Direct Forgiveness portal.

To get answers to your questions, call the SBA Hotline at (877) 552-2692

Monday through Friday, 8 am to 8 pm ET.

Learn how to apply on the portal

User Guide (PDF)

SBA webinar explaining how to apply on the portal (video)

SBA PPP Loan Forgiveness FAQs

Read the SBA’s answers to frequently asked questions about PPP loan forgiveness

FAQs

We understand you may have questions about PPP loan forgiveness and have put together the responses below to help keep you informed.

The Small Business Administration and the Department of Treasury

establish the guidelines for PPP loan forgiveness.

For the latest information, visit the official websites: SBA and U.S. Treasury

Answers to Questions About PPP Loan Forgiveness

- What is loan forgiveness?

If you qualify for loan forgiveness, a portion or the full amount of your loan will not need to be repaid. - How do I determine if my loan can be forgiven?

To be eligible for loan forgiveness, you must spend the funds on payroll and other eligible expenses during the Covered Period. The Covered Period is between 8 weeks and 24 weeks after the date that your loan was disbursed. Learn more about the Covered Period and payroll and other eligible expenses. - How do I get my loan forgiven?

Loan forgiveness is not automatic. You must apply for forgiveness directly with the SBA using their online portal. Click here to apply for forgiveness now. - When do I need to apply for forgiveness?

You have 10 months after the end of your Covered Period to apply for forgiveness. This time is referred to as your Deferral Period. You do not need to make payments of principal or interest during your Deferral Period. (See question #2 to understand Covered Period). - How long does it take to find out if my loan has been forgiven?

Guidelines established by the SBA permit lenders up to 60 days from the date we receive a forgiveness application to review and submit to the SBA. Then, the SBA may take up to 90 days to make a final decision on your application. Please continue to chec the SBA PPP Direct Forgiveness portal for the status of your forgiveness application. - What happens if my loan is not forgiven?

You will be required to repay the amount that is not forgiven. A repayment schedule, specifying a monthly payment amount, will be sent to you.

If you applied for your loan with Womply, you may want to visit their website to review answers to other questions about forgiveness.

Read the SBA’s Borrower FAQ on Direct Forgiveness

Contact

- [email protected]

- (305) 676-9632

- SW 97th Avenue Suite 201Miami, FL 22173

Helpful links

- Blog

- Customer Service

- Recently Closed Deals

- Investor Portal

News & Policy

- Legal Disclosures

- Privacy Policy

- Privacy Statement

Social

© 2021 Benworth Capital Partners, LLC & Benworth Financial, LLC. All rights reserved.

Benworth Capital Partners, LLC is a licensed mortgage lender, NMLS #374363 ![]() Equal Housing Lender.

Equal Housing Lender.

Benworth Financial, LLC is a licensed Consumer Finance Company.